Losing money with In-The-Money options on the NSE

I burnt my fingers on a winning trade this month. I was holding a position that looked pretty secure at expiration but still lost money! I didn't pay much attention to transaction costs on my back of the envelope calculations (bad practice!) but had almost forgotten about the change of a cost called STT (Securities Transaction Tax) and the calculation at expiration!

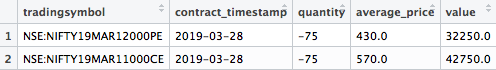

The issues was as follows. I was holding the following In-The-Money options at expiry

The NIFTY underlying closed at 11570 resulting in a payoff of 430 on NIFTY19MAR12000PE and 570 on NIFTY19MAR11000CE. All good so far!

Now, here is where things get ugly! STT on normal option trades done on the exchange is charged at 0.05% of the selling side of the premium value.

However, on exercise .. STT on BUY option positions that get exercised is 0.125% of the entire CONTRACT VALUE.

In other words, for the trade shown above:

The STT prior to expiration for each of the trades are:

430*.05%*75 = 16.125

570*.05%*75 = 21.375

A total STT of 37.5

However, on exercise .. STT on BUY option positions that get exercised is 0.125% of the entire CONTRACT VALUE.:

(0.125/100)*(11570)*75 = 1084.688

(0.125/100)*(11570)*75 = 1084.688

A total of 2169!!

And there goes all my profit and I actually incurred a LOSS on this trade!

Do remember that if you are short/written options (sold first), you have already paid STT and it doesn’t matter if you buy the options on the exchange or hold them till expiry to square off, there is no STT on the buying side.

Currency trading in India presently has no STT levied by the government and hence you don’t have to be worried about paying higher STT while trading currency options on the expiry day.

References

- STT: Now, ‘Do Not Exercise’ to escape STT blow on in-the-money option - The Economic Times

- STT Trap - Options Expiry - NSE BSE MCX-SX – Z-Connect by Zerodha Z-Connect by Zerodha

- NO MORE STT trap on exercised In the money options - General - Trading Q&A by Zerodha - All your queries on trading and markets answered