Empirical analysis of put-call parity

I was wondering this morning on the viability of making money from arbitrage using put-call parity.

Put Call Parity as explained well here defines the relationship between calls, puts and the underlying futures contract.

This principle requires that the puts and calls are the same strike, same expiration and have the same underlying futures contract. The put call relationship is highly correlated, so if put call parity is violated, an arbitrage opportunity exists.

The formula for put call parity is c + k = f +p, meaning the call price plus the strike price of both options is equal to the futures price plus the put price.

For this to work, as one can imagine, we need the components to be very liquid. NIFTY derivates (on the NSE) are potential candidates for this. Equity derivatives are less liquid and such arbitrage opportunities may be tougher to execute.

The theory makes one dream of the eternal passive income! Unfortunately, my analysis shown below quickly shattered my dreams! :-(

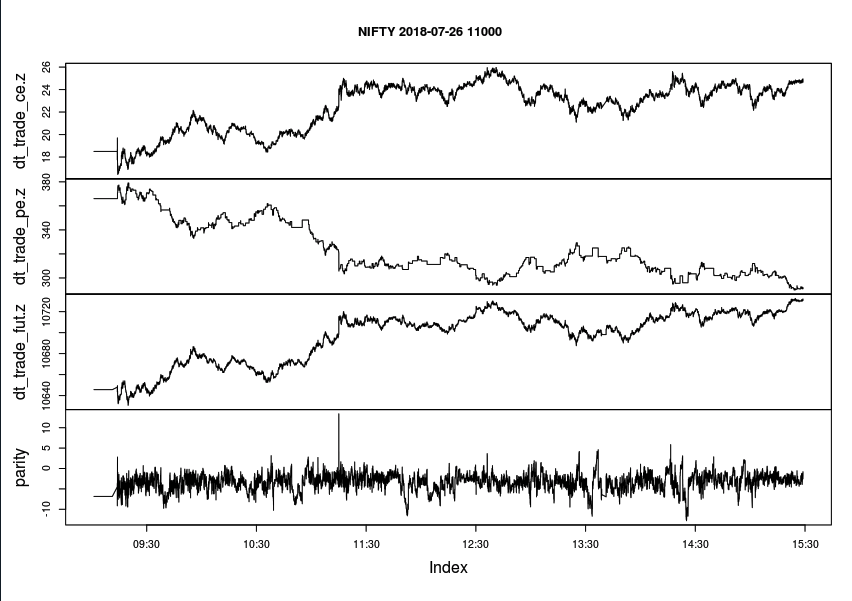

I put together the arbitrage pairs using a time-interval of 5 seconds. I tried the strategy for various strikes and the execution opportunities make it impractical for an individual trader like me! :(

As it can be seen from the chart below, the put-call parity holds pretty well and the arbitrage opportunities are very shortlived and unviable to casual traders!

Need to get back to working hard! :-P